We have been hosting a series of webinars alongside Comply Direct about this new plastic tax to help businesses prepare and ensure they are compliant. During the webinars, we received many interesting questions.

In this article, we answer the most frequently asked questions surrounding the plastic tax. Including:

- How is the 30% recycled tax calculated?

- What if you have items with more than 30% RPC or just a little bit less than 30% RPC?

- If the packaging is by weight in majority non-plastic, is then the plastic component exempt from taxation?

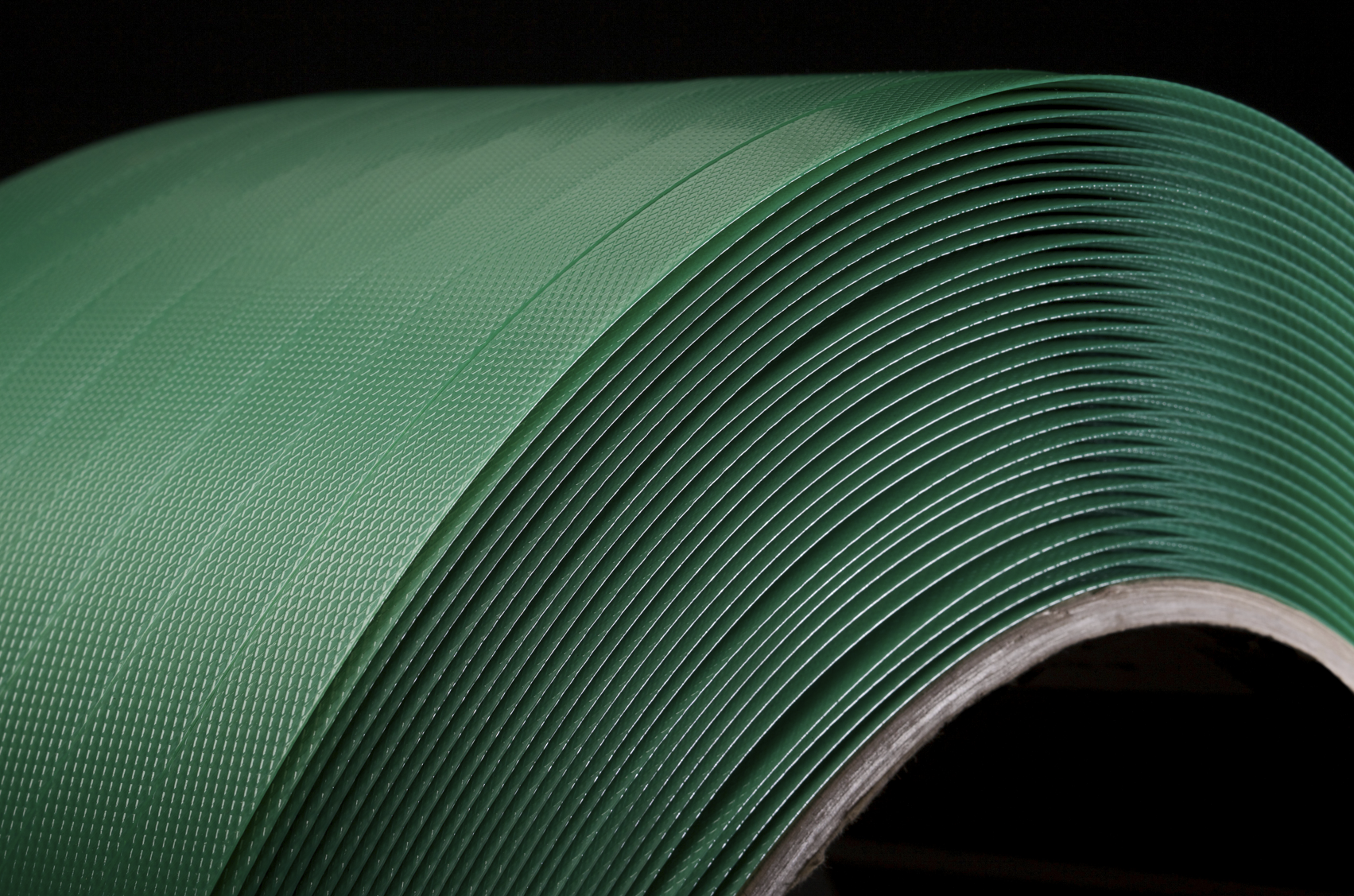

- Are products such as plastic wrap, plastic strapping and corner protection strips liable?

- How does the reporting process work and how is the tax paid?

- If packaging is made up of majority of paper but contains plastic that is 100% virgin is that within scope of the tax?

- For a container such as a plastic bottle, does the tax apply to the total unit or the individual components eg: the cap/label/bottle?

- If a UK company has products packed outside the UK and imports them as a finished product, who pays?

- With the pre-consumer recycled plastic definitions: Can we re-purpose stocked material/products and would this be considered as recycled plastics?

- When purchasing pallet wrap from a UK supplier, would that mean that the supplier is liable?

- What would be required to prove recycled content if importing plastics?

- Are there any exempts from the tax?

- Why are compostable and biodegradable plastics included in the tax?

Please do keep in mind that new information is coming out regularly, so information might change.